The New Jersey Housing and Mortgage Finance Agency (“NJHMFA”) administers the federal low income housing tax credits (“LIHTC”) in the state of New Jersey. They require that developers submit a third-party financial analysis that shows the project would not be financially viable without the LIHTC. The analysis compares the returns for the market-rate component of the project (as if being developed independently) to the combined project with and without the LIHTC.

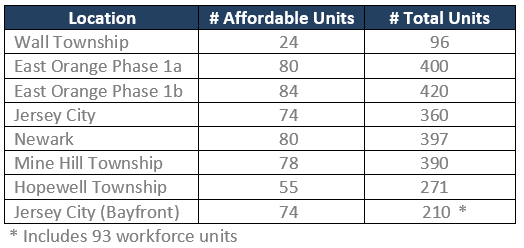

RESGroup has worked on behalf of several developers to provide them with the required third-party financial feasibility studies. Developers provide RESGroup with their application, including a pro forma of the project costs, sources of funds , estimates of operating income and expenses, a market study and/or appraisal report for the proposed project as background for RESGroup to create an independent analysis of the returns. Projects to date are as follows:

https://nj.gov/dca/hmfa/dca/hmfa/developers/docs/lihtc/tax/Inclusionary_Review_Analysts_list.pdf